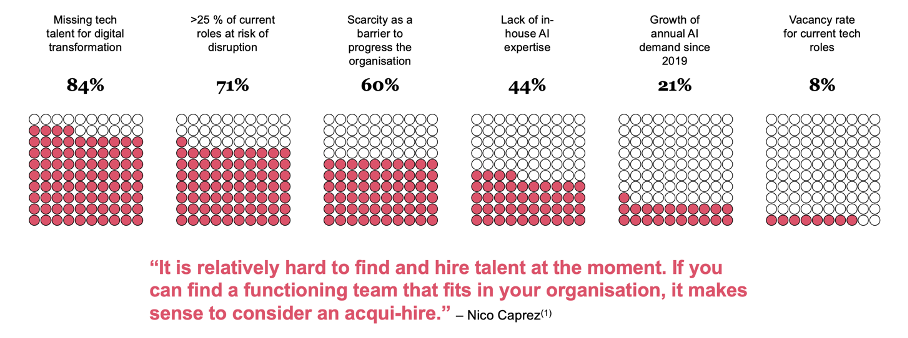

Global businesses today face a critical technology talent shortage, forcing executives to seek creative solutions beyond traditional hiring. An overwhelming 84% of CEOs and other C-level leaders report a lack of tech talent hindering their digital transformation efforts, and 44% admit to a shortage of in-house AI expertise. This skills gap is widening just as demand for AI and digital capabilities grows ~21% annually. Conventional hiring alone cannot fill this breach, prompting firms to explore alternatives like contracting specialists or forming partnerships. However, those approaches keep expertise external to the organization. Even traditional M&A (buying a company for its product/customers and hoping the talent stays) is an inefficient way to acquire people. Intermediate strategies have emerged – for example, "tech-and-talent" deals (acquiring a startup's IP along with its team, but not its revenue base) – as well as team lift-outs (poaching an entire team from another company). Yet these can be fraught: direct lift-outs risk hostile talent wars and even violate no-poach understandings between industry players. In this context, acqui-hiring has gained traction as a faster, more controlled way to bring crucial talent in-house.

Share of C-Level executives identifying talent gaps

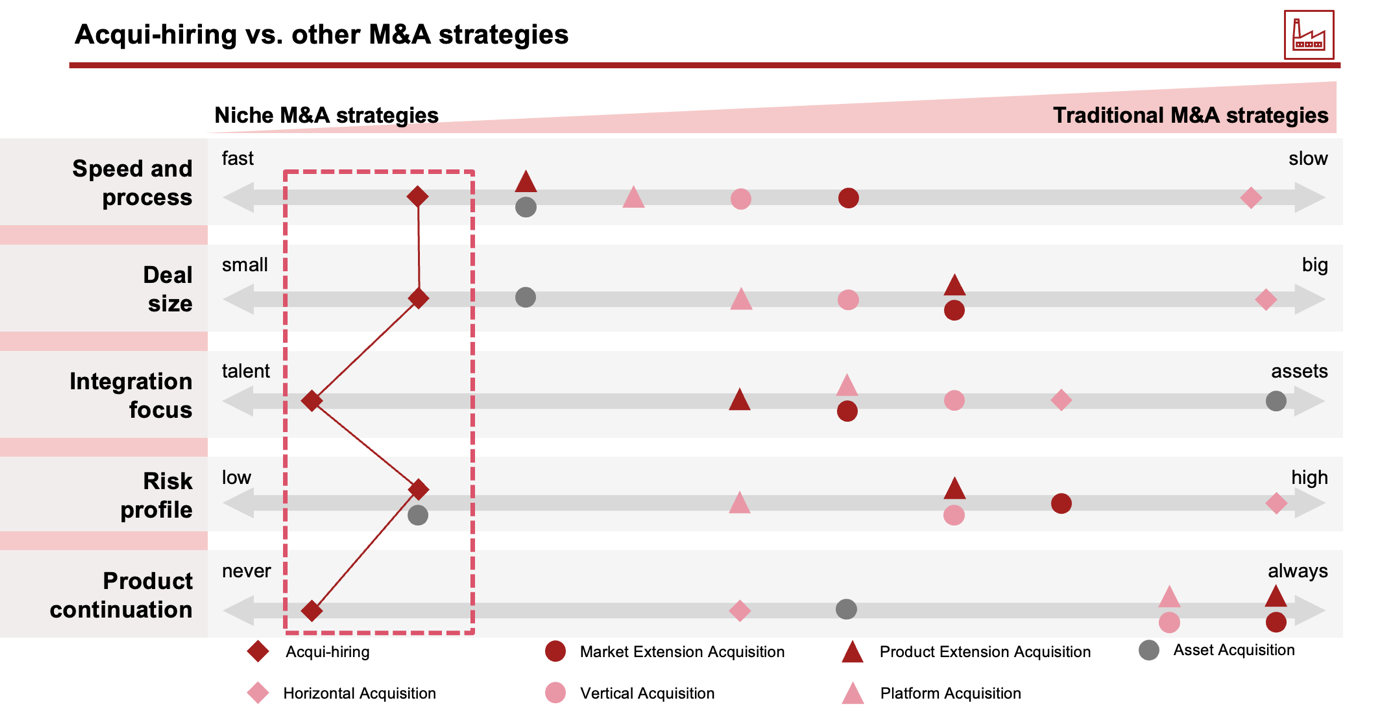

Unlike outsourcing or team lift-outs, acqui-hiring involves acquiring an entire company primarily for its employees. The acquired team joins the new parent firm outright, eliminating external reliance and competitive tensions. This approach allows a company to rapidly scale up expertise by "buying" a ready-made team. As one expert noted, "in some ways it's more efficient to just acquire 50 people at once…that's quicker and easier than doing 50 separate recruitments". Indeed, acqui-hire transactions stand out from other M&A strategies across five dimensions: Speed and process, deal size, integration focus, risk profile and product continuation.

Why would a firm pursue such a focused "talent acquisition" approach? Based on expert interviews, we identified five main drivers that lead companies to acqui-hire:

Hiring does not fill the talent gap

As talent scarcity increases acqui-hiring becomes an effective way to scale talent and gain expertise in masses not possible through regular hiring.

Customer demands keep rising

Companies have to continuously develop their product offerings. Acqui-hires can speed up the development and accelerate growth.

Proven teams save scarce time

In periods of rapid change, there's no time for an adjustment period. A team with a proven track record can hit the ground running.

Get ahead before everyone can do it

Emerging topics only bring a handful of experts with them. Getting access to niche expertise early on can lead to a big advantage down the road.

Bypass labour laws through M&A

Certain geographical areas allow non-competes. Through an acquisition the acquirer doesn't have to deal with this regulatory issue.

M&A Market Overview

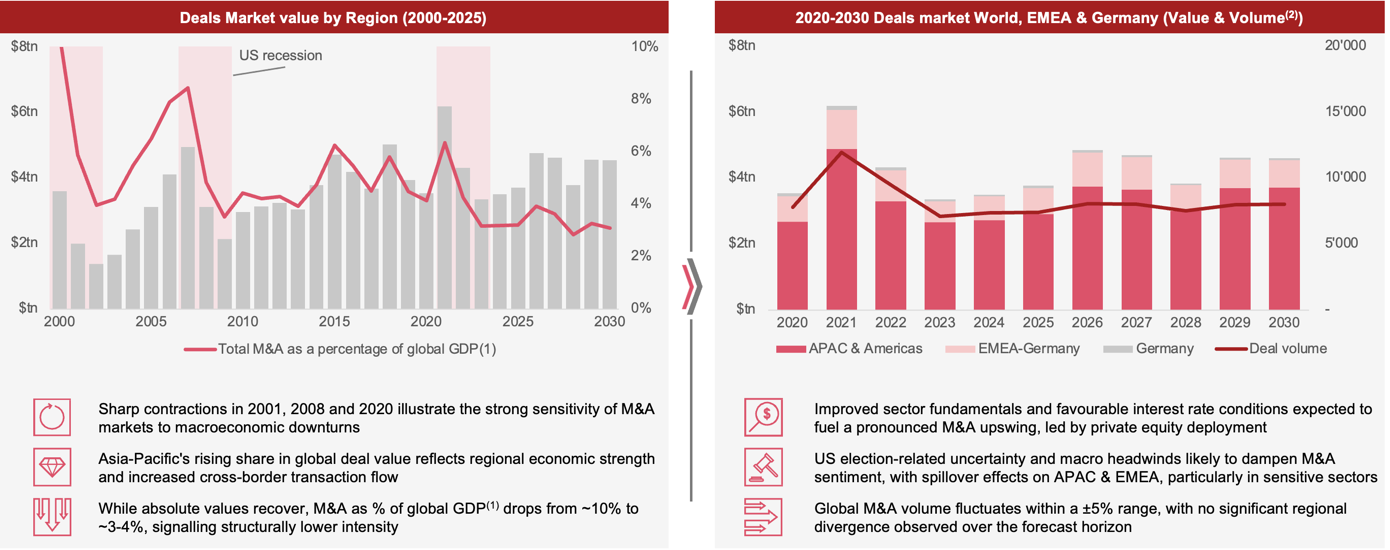

Over the past five years, global M&A activity has seen boom and dip dynamics, creating the backdrop in which acqui-hiring plays a modest role. The year 2021 marked a historic peak for dealmaking amid cheap capital and post-pandemic optimism. This frenzy was followed by a sharp cooldown: as interest rates rose in 2022, worldwide M&A deal volume contracted by over 15% in 2023. By 2023–2024, annual deal value stabilized around $1.8 trillion – roughly 46% below the 2021 high. All major regions felt the pullback. The Americas saw total M&A value drop nearly half from 2021, while Europe, the Middle East & Africa (EMEA) declined ~40% and Asia-Pacific ~42% over the same period.

Deals Market Analysis

Notes: (1) GDP forecasts from International Monetary Fund (IMF) (2) Deal Volume for deals above $30mn in deal size

Encouragingly, 2024 brought early signs of a rebound. Deal activity ticked up slightly (Americas +1%, EMEA +7%, APAC +10% year-on-year) as markets adjusted to the new financial conditions. Particularly in APAC and EMEA, confidence began returning, aided by resilient economic fundamentals. While M&A remains below the 2021 frenzy levels, the overall market appears to have bottomed out and entered a cautious recovery phase. This wider context is important because acqui-hiring, as a subset of M&A, tends to follow the boom-bust cyclicality of the tech sector's fortunes. "There are some pretty important tectonic structural changes that motivate deal making. The biggest one is AI and technology." Daniel Friedman (Senior Partner at BCG)

Sector-region impact matrix(1)

Americas

EMEA

APAC

Notes: (1) Impact values reflect how key drivers (interest rates, economic growth, political stability, dry powder, profit pools, tech disruption) shape M&A dynamics per sector-region. Based on their influence on deal acceleration or constraint, aligned with market scenarios (2) TMT = Technology, Media and Telecom (3) IRA = Inflation Reduction Act (4) FMCG = Fast Moving Consumer Goods (5) DTC = Direct-to-Consumer

Amid this vast deal landscape, acqui-hiring occupies a niche. By volume and value, it represents only a sliver of total activity – around 0.5% of tech-sector M&A deals since 2020. In concrete terms, out of roughly 64,000 global tech M&A transactions over 2020–2024, only about 78 were publicly identified acqui-hire deals. Many acqui-hires fly under the radar (small enough to avoid disclosure), so the true count is higher – estimated closer to 300 deals when including undisclosed "stealth" acquisitions. Still, even 300 transactions over five years is minuscule relative to overall M&A volume. Most tech companies do not regularly engage in acqui-hiring; it tends to be a specialized tactic concentrated among certain acquirers.

Global deals market (all industries)

Overall M&A deal volume across all industries globally

Technology deals market

Overall M&A deal volume in the global technology market

Defined subset of frequent tech acqui-hirers deals market

Based on a sample of large and well-known technology companies

Acqui-hiring deals market for the technology sector

According to the criteria shown on the left, we filtered all the deals of the selected firms to identify the share of total deals that might be classified as talent-driven and therefore acqui-hiring

Figure: Breakdown of Deals Market by Segment (Data since 2020) - Click each section to expand/collapse

Who are the players?

A handful of big tech firms dominate acqui-hiring activity. These are typically cash-rich companies on the cutting edge, for whom securing top talent is a strategic priority. For instance, Amazon alone executed roughly 10 acqui-hires between 2020 and 2024, often small startups in areas like retail tech, voice assistants, or AI. Twitter made around 6–7 acqui-hire deals (circa 2020–2021) in domains ranging from newsletter platforms to design studios. Google, Microsoft, Apple, Facebook/Meta, Salesforce and a few others also appear frequently as acquirers. These firms have the deep pockets, in-house M&A teams, and brand appeal to continually pull in talent via acquisitions. In contrast, most other tech companies appear only once or not at all in acqui-hire data – underscoring that this strategy is not ubiquitous, but rather used by organizations with very specific growth and capability needs.

Challenges and Success Factors

While acqui-hiring can quickly inject much-needed talent, it also presents people-related challenges that must be carefully managed. Our analysis of expert insights surfaced five major challenges:

Cultural differences

71%

Organisational structure

60%

People integration

70%

Product termination

39%

Talent retention

62%

Notes: (1) Subset of our interviews (n=24) conducted with corporate development, acqui-hired people, PMI specialists & venture capital firms; additionally, TechCrunch articles (n=231) and CrunchBase articles (n=9) were included in the analysis (2) DD = Due Diligence

Retention Case Study

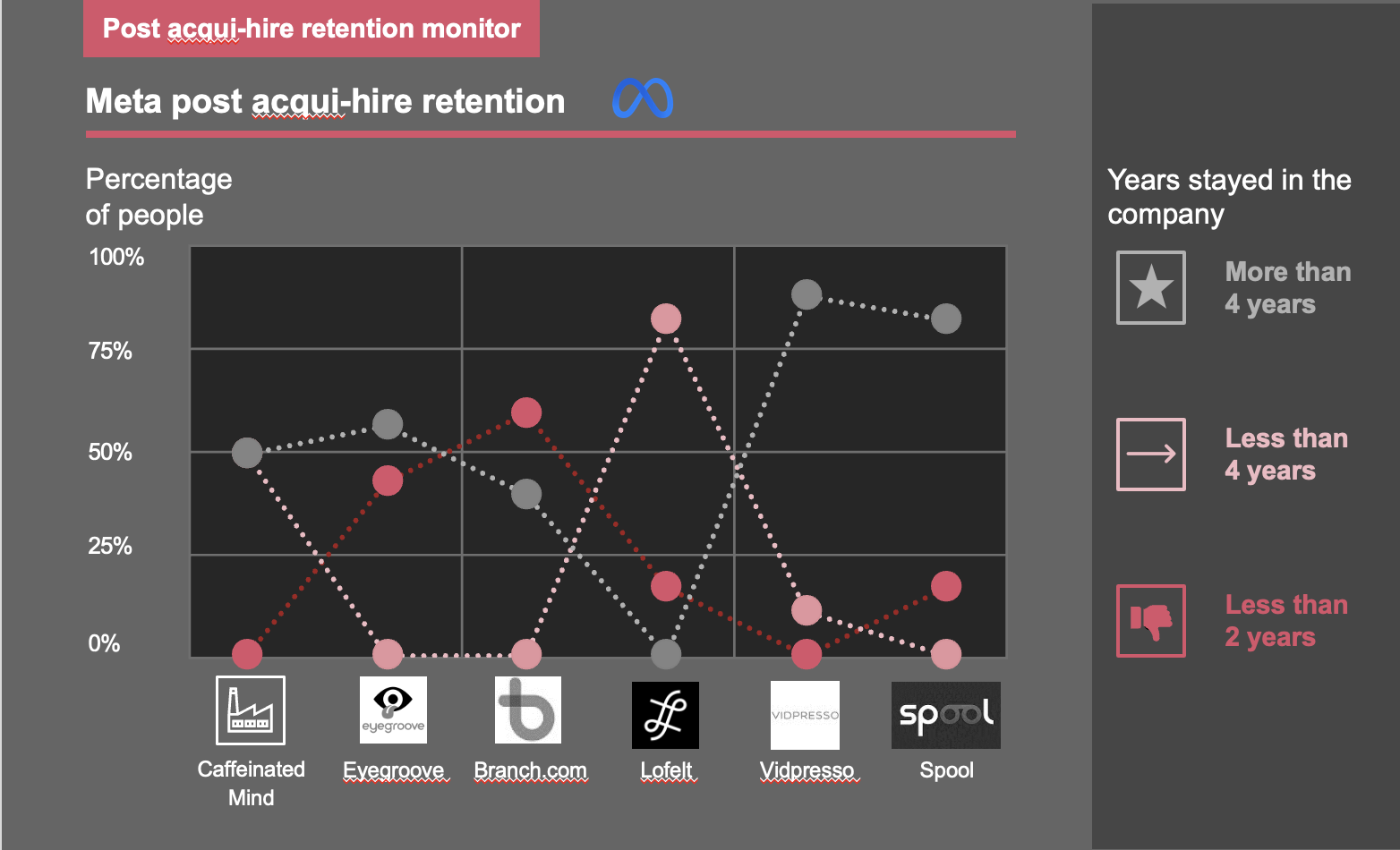

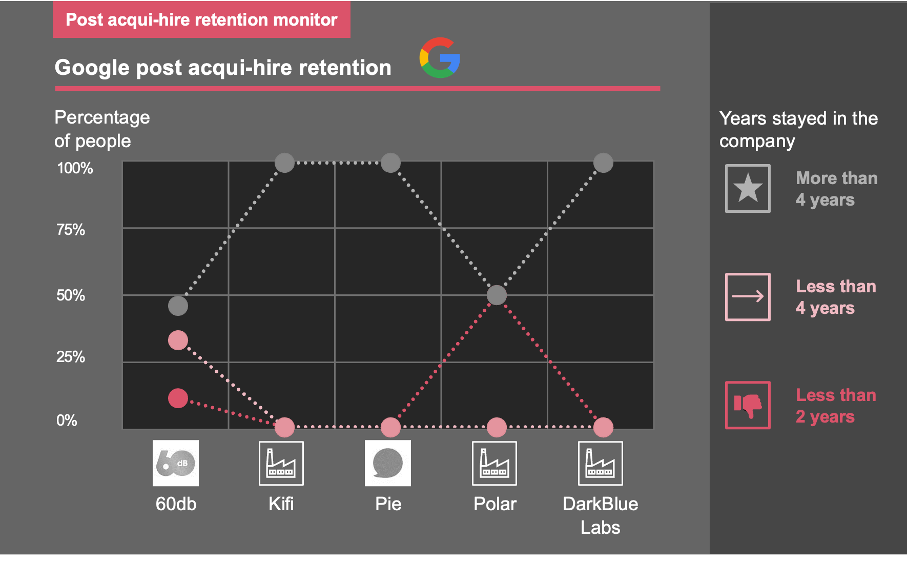

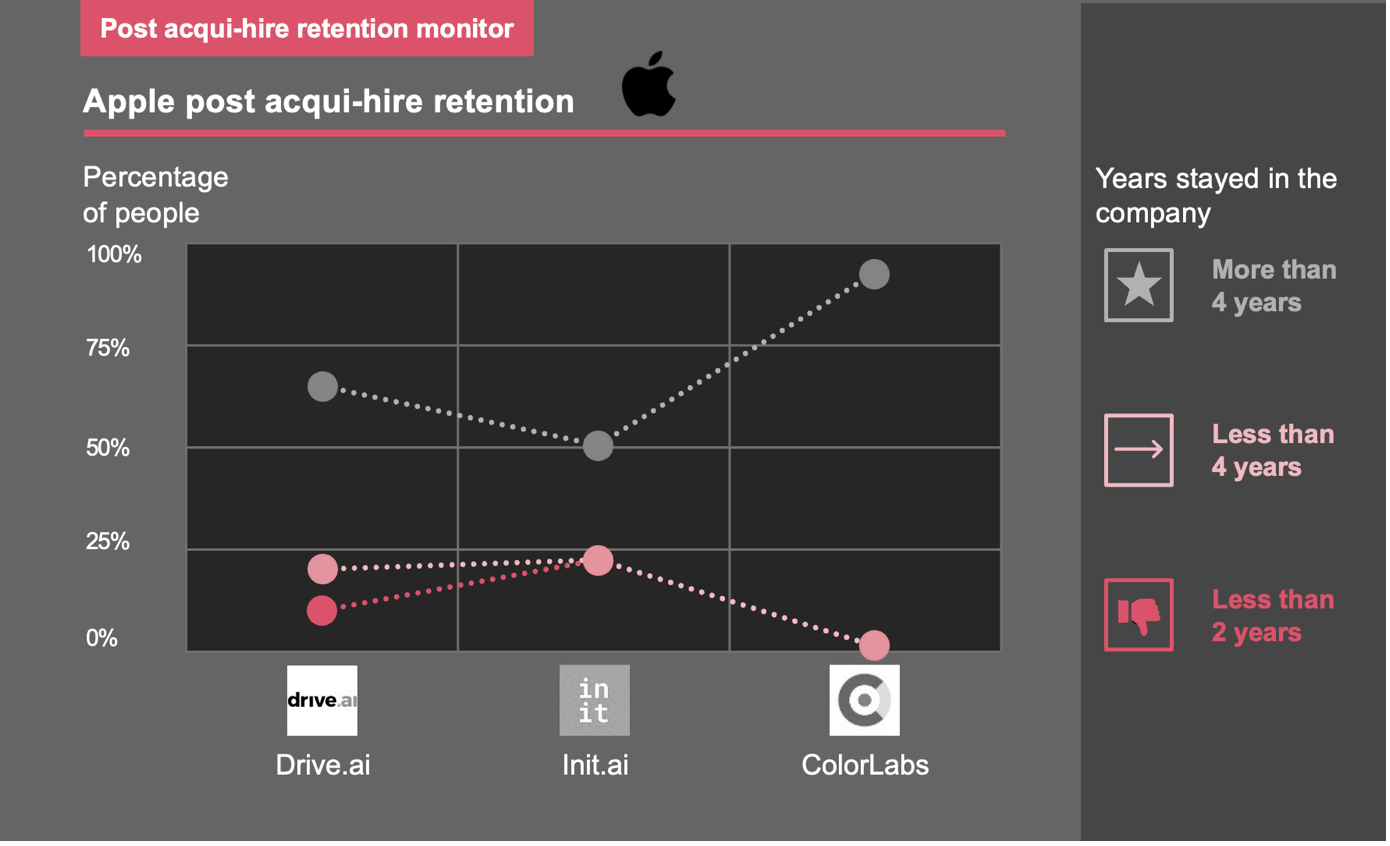

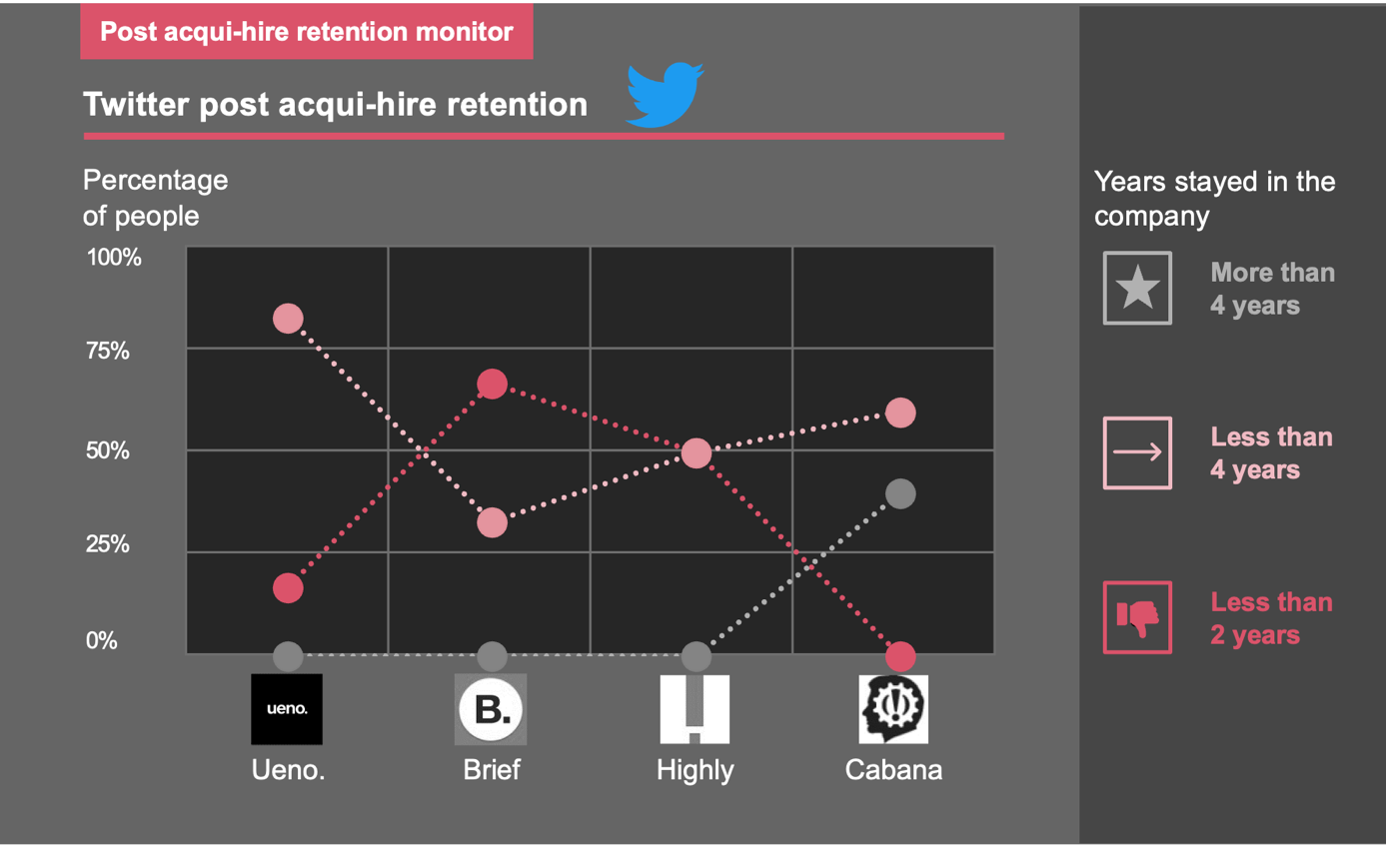

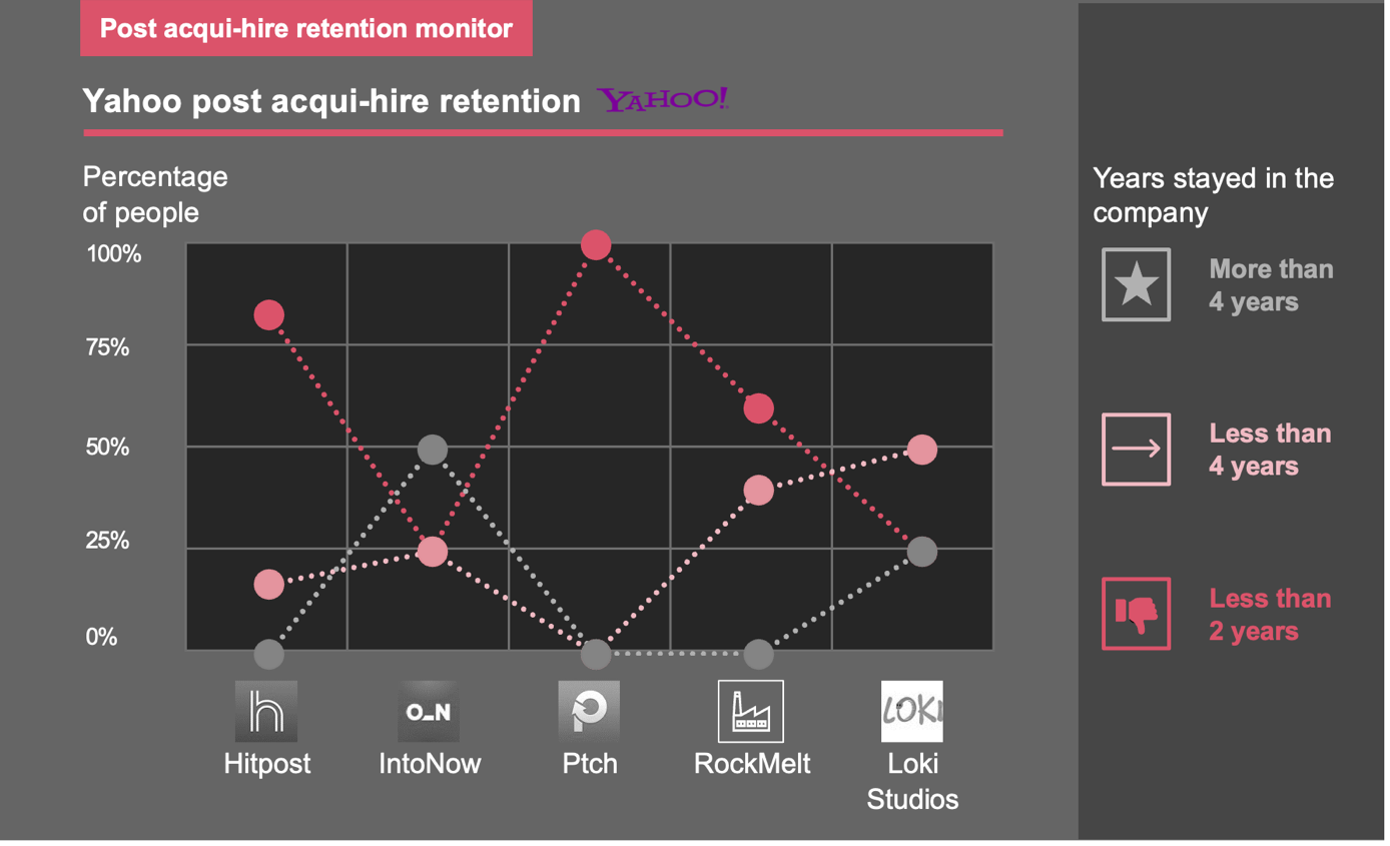

A recent case study examining acqui-hire outcomes at six major tech companies – Google, Apple, Meta (Facebook), Airbnb, Yahoo, and Twitter – provides a revealing look at how retention plays out in practice. The findings confirm that while acqui-hiring secures talent initially, keeping that talent long-term is an entirely separate challenge. Across these firms, roughly half of the acqui-hired employees left by the four-year mark after acquisition, which coincides with the typical vesting schedule for stock grants and bonuses. In other words, once the "golden handcuffs" expired around year four, about 50% of acqui-hire employees on average decided to depart. This four-year turnover spike was visible at nearly every company studied, underscoring how strongly financial incentives had been retaining people up to that point. Early departures (within the first 1–2 years) were comparatively less common, except in cases of really poor integration or a quick mismatch – which again shows the initial packages were effective in locking in talent at least for a few years.

Select a company to view retention data:

However, the retention performance diverged widely between companies. Google and Apple stood out at one end of the spectrum with exceptional retention outcomes. At these companies, a majority of acqui-hired team members stayed well beyond four years, many becoming long-term employees who continued contributing past their vesting dates. In contrast, Yahoo and Twitter had the poorest retention among the six. At these companies, acqui-hired employees often left as soon as they could, with very few staying beyond the obligatory four-year window. In several Twitter acqui-hire deals, none of the acquired team members remained after four years. For instance, Twitter's 2021 acqui-hire of the design agency Ueno saw its entire team depart within 2–3 years – not a single person stayed to year four. Yahoo and Twitter both struggled with strategic turbulence and cultural issues during those years – Lack of career development opportunities, dissatisfaction with leadership and expired compensation packet, were cited by many acqui-hire alumni as reasons for leaving. These cases illustrate how a mishandled integration or an incoherent post-deal environment can squander an acqui-hire's potential value.

Crucially, these case study lessons hammer home that retention must be actively managed. It is not an automatic outcome of an acqui-hire deal. Companies that treat an acqui-hire as "done" once the contracts are signed will likely see their new talent walk out in a few years. To reap the full value of acqui-hiring, firms need to follow through on the hard part: integrating the team culturally and structurally, providing exciting work and clear career progression, and maintaining open communication. This means applying the success factors discussed in Section 3 – e.g. having a tailored integration plan, fostering two-way communication, and aligning roles to the talent's passions – in practice. As the data showed, those firms that built clear career paths and preserved the entrepreneurial spark for the acqui-hired teams ended up far more successful in retention. In essence, the case study validates that an acqui-hire's success isn't just in the quick win of acquiring talent, but in the longer journey of turning that talent into lasting contributors. Companies that recognize this and invest in their acqui-hired people for the long haul are the ones who ultimately realize the true strategic value of acqui-hiring.